Raise Funds Without Losing Control: Key Strategies

Raising funds is like sailing through a storm. I've been through the fundraising wringer more times than I can count, and if there's one thing I've learned, it's this: preparation is everything. Whether you're dealing with European or American investors, every detail matters. Let me guide you through this maze without losing your shirt—or your company. We're diving into everything: the differences between European and American investors, legal prep, term sheets, and even using BSR as a fundraising tool. Don't get burned by antidilution clauses or inflated valuations. Let's explore key strategies to raise funds without losing control.

I've been through the fundraising wringer more times than I can count, and if there's one thing I've learned, it's this: preparation is everything. Whether you're dealing with European investors or their American counterparts, the devil is in the details. Let me walk you through how to navigate this maze without losing your shirt—or your company. We'll dive into the differences between European and American investors, the crucial legal preparations, and how understanding and negotiating term sheets can make or break your deal. Watch out for antidilution clauses and inflated valuations that can burn you. We'll also discuss the role of specialized startup lawyers and strategies for early-stage fundraising. If you want to raise funds without losing control, you're in the right place.

Navigating Investor Differences: Europe vs USA

When I dove into the complex world of fundraising, I quickly realized that European investors and American ones operate with different mindsets. European investors tend to focus on sustainable growth, whereas their American counterparts often bet on rapid scalability. This distinction is crucial when planning your fundraising strategy.

Next, delve into the legal and financial expectations unique to each region. In the US, for instance, it's possible to issue up to 100 million in a certificate. This might sound appealing, but beware of valuation traps. What seems generous can dilute your control.

- First, assess your company's growth stage.

- Then, target your market carefully.

- Utilize the 100 million issuance potential in the US strategically.

Legal Preparations: Your Fundraising Foundation

Before diving into fundraising, it's imperative to lay solid legal groundwork. I've learned the hard way that neglecting this aspect can lead to costly mistakes. Founder agreements and vesting schedules are not just formalities. They're essential for aligning interests and avoiding future conflicts.

In France, each share has a nominal value of 1 centime. This has direct implications for equity distribution. From the start, map out your legal needs and engage the right experts. I've often seen startups underestimate the importance of consulting specialized startup lawyers early in their journey.

- First, map out your legal needs.

- Then engage the necessary experts from the beginning.

Decoding Term Sheets: Key Components to Master

Term sheets are like your roadmap – you need to get comfortable with the terminology. I've seen entrepreneurs get caught out by antidilution clauses, particularly the full ratchet, which can be a double-edged sword. A 500 million valuation sounds impressive, but what's the catch?

Dissect each term and align them with your strategic goals. Remember, what seems like a good deal can often hide traps.

- First, dissect each term in the term sheet.

- Then align the terms with your strategic goals.

BSR and Vesting: Tools for Long-term Success

BSR can be a powerful lever in negotiations, but use it wisely. I've seen startups mismanage vesting, which complicated founder dynamics. In France, it's common to reserve 5% of equity for the team, but you must balance incentives with control.

First, establish clear vesting terms and communicate them effectively. This will prevent misunderstandings and misalignments between founders and investors.

- First, establish clear vesting terms.

- Then communicate the terms effectively to stakeholders.

Early-stage Fundraising: Strategies and Pitfalls

Early-stage fundraising is an art – timing and narrative are key. I've often seen startups rely too heavily on their network, forgetting to develop a long-term vision. Raising 1 million might seem sufficient to start, but what about the long-term vision?

First, craft a compelling story, then back it with solid numbers. Avoid common pitfalls like overvaluation or underprepared pitches.

- First, craft a compelling story.

- Then back your story with solid data.

Fundraising isn't just about chasing big numbers, it's a meticulous craft of strategy and preparation. I've seen firsthand that understanding the differences between European and American investors can be a game changer. Expectations vary, and that can seriously impact negotiations. Plus, never underestimate the power of solid legal groundwork; it's crucial to avoid getting burned. And those term sheets? They're not just paperwork; grasping the subtleties of vesting clauses and founder agreements is essential to safeguard your future.

Looking ahead, I believe investing in these skills can truly transform your company's sustainability. Be prepared, anticipate every twist, and make sure you've got the right tools in your arsenal.

Ready to take it to the next level? Watch the full video for even deeper insights. Trust me, between peers, it's worth it.

Frequently Asked Questions

Thibault Le Balier

Co-fondateur & CTO

Coming from the tech startup ecosystem, Thibault has developed expertise in AI solution architecture that he now puts at the service of large companies (Atos, BNP Paribas, beta.gouv). He works on two axes: mastering AI deployments (local LLMs, MCP security) and optimizing inference costs (offloading, compression, token management).

Related Articles

Discover more articles on similar topics

Platform Growth Strategies for Creators

I built a platform creators didn't know they needed. It's not just about tech; it's about empowering creators, owning data, and shifting from ads to transactions. I connected the dots between user growth, revenue model transitions, and the impact of tech giants. It's a complex dance, but by orchestrating the right strategies, we make a difference. Join me on this journey where I share how I tackled these challenges and the lessons learned along the way. You'll find out how I hit 100 million ARR and ensured new users make their first dollar within a minute.

Deploying Kimmy K2: My Workflow Experience

I've been hands-on with AI models for years, and when I got my hands on the Kimmy K2 Thinking model, I knew I was diving into something potent. This model marks a significant evolution, especially coming from a Chinese company. With its impressive technical capabilities and implications for the future of AI, Kimmy K2 isn't just another model; it's a tool that excels in real-world applications. Let me walk you through how it stacks up against others, its technical features, and why it might be a game changer in your workflow.

Staying Relevant in Tech: 25 Years of Lessons

I've spent over 25 years in the tech industry, and if there's one thing I've learned, it's that staying relevant means more than just keeping up with the latest languages or frameworks. It's about owning your career path, adapting to change, and continuously iterating on your skills. In this article, I share how I've managed to stay ahead in this ever-evolving field. Whether you're a newbie or a veteran, the tech landscape is always shifting. New technologies emerge, and the skills in demand today might not be tomorrow. This article isn't just about theory; it's a practical guide drawn from my personal journey and the lessons I've learned along the way.

Setting High Expectations in Tech Teams: My Approach

I've navigated the maze of promotions, salary negotiations, and leadership roles in tech. It's not just about coding; it's about setting high expectations, balancing speed with quality, and leveraging AI tools effectively. In this article, I share my firsthand experiences and strategies that have shaped my tech career. From team management to the smart use of AI tools, let's dive into what truly makes a difference.

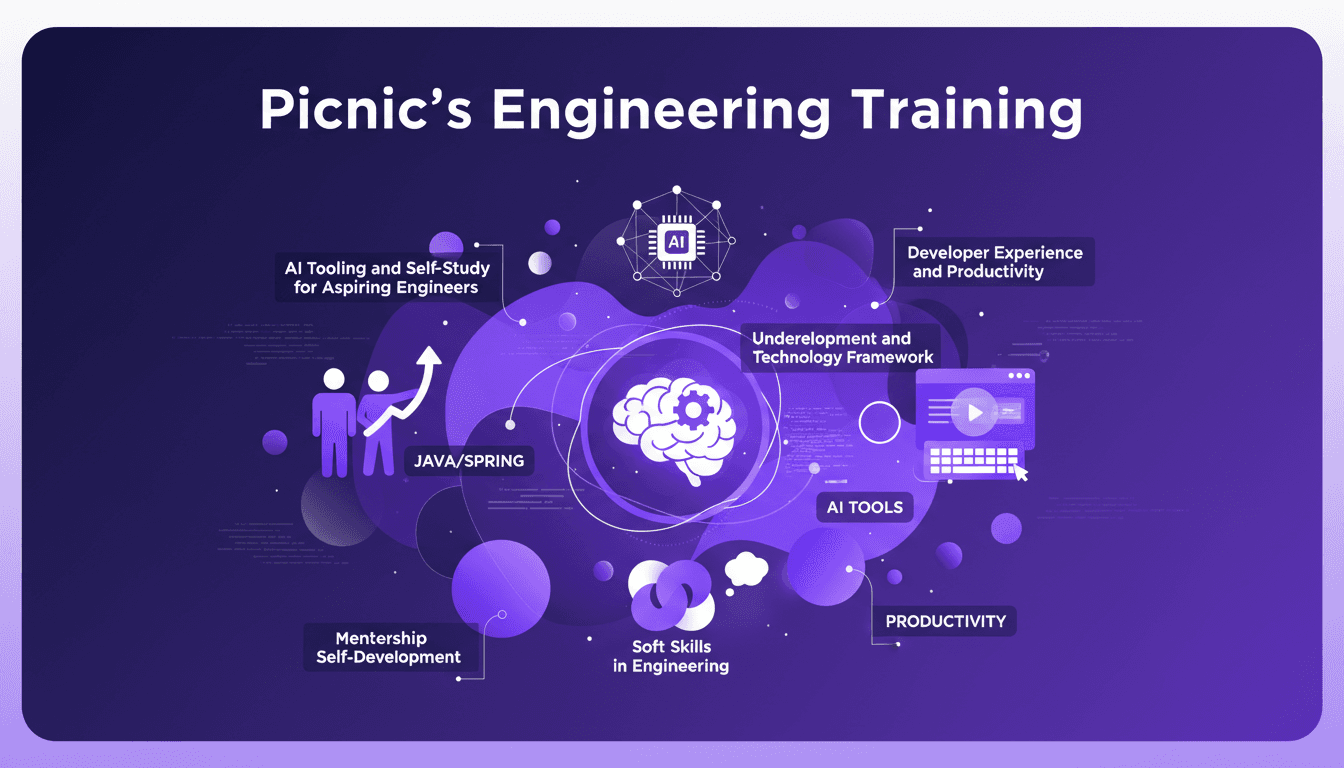

Elevate Your Engineering with Picnic

I remember the first time I walked into Picnic's training program. It was like stepping into a new world of engineering. The energy was palpable, and the focus on not just coding, but thinking like an entrepreneur, was a game changer. In the engineering world, standing out means more than just knowing your code. It's about mindset, continuous learning, and leveraging the right tools. Let's dive into how Picnic's approach bridges the gap between good and great engineers. We're talking Java, Spring Framework, and the importance of deeply understanding technology, not to mention soft skills and AI tooling for aspiring engineers.