Evolving Quantitative Trading with AI

Back in the 80s, I watched hedge funds start using computers to analyze markets. Fast forward to today, and AI is reshaping the landscape. I've been deep in the trenches, integrating AI into hedge fund strategies—it's a game changer, but not without hurdles. From the evolution of quantitative trading to the rise of AI native hedge funds, I'm taking you behind the scenes of this transformation. It's more than just a tech upgrade; it's a paradigm shift. We'll dissect how AI automates financial analysis and creates new trading strategies while tackling the challenges traditional funds face in adopting these technologies. Ready to explore the future of AI native hedge funds?

Back in the 80s, I watched hedge funds start dabbling with computers to analyze markets. Fast forward to today—AI is reshaping the landscape. I've been in the trenches, integrating AI into hedge fund strategies, and it's a game changer, but not without its hurdles. First, we saw the evolution of quantitative trading, which allowed us to systematize the analysis of 10Ks and other financial data. Then, I orchestrated AI integration, and it changed the game. But watch out, it's not without bumps. There are technical challenges, cultural resistance in traditional funds, and the constant chase for performance. I'm going to show you how AI automates financial analysis and creates new trading strategies. And most importantly, how AI native hedge funds are emerging as a formidable force. So, are we diving into this future together?

The Evolution of Quantitative Trading

Quantitative trading kicked off in the 1980s, a time when using computers to analyze markets seemed like a futuristic leap. Back then, it was hard to foresee the impact it would have. But today, quantitative trading is a no-brainer in the financial industry. Without data and algorithms, you're simply not in the game. Now, with the advent of artificial intelligence (AI), the game is evolving further, promising faster decisions and deeper insights.

For instance, I've applied AI to my trading models with astonishing results. Adjustments that once took days can now be optimized in hours. But be cautious, AI isn't a magic wand—it requires quality data and a clear understanding of its limits.

"The future of hedge funds lies in building new strategies based on AI."

- Started in the 1980s with computer analysis of markets

- Quantitative trading relies on data and algorithms

- AI offers faster decisions and deeper insights

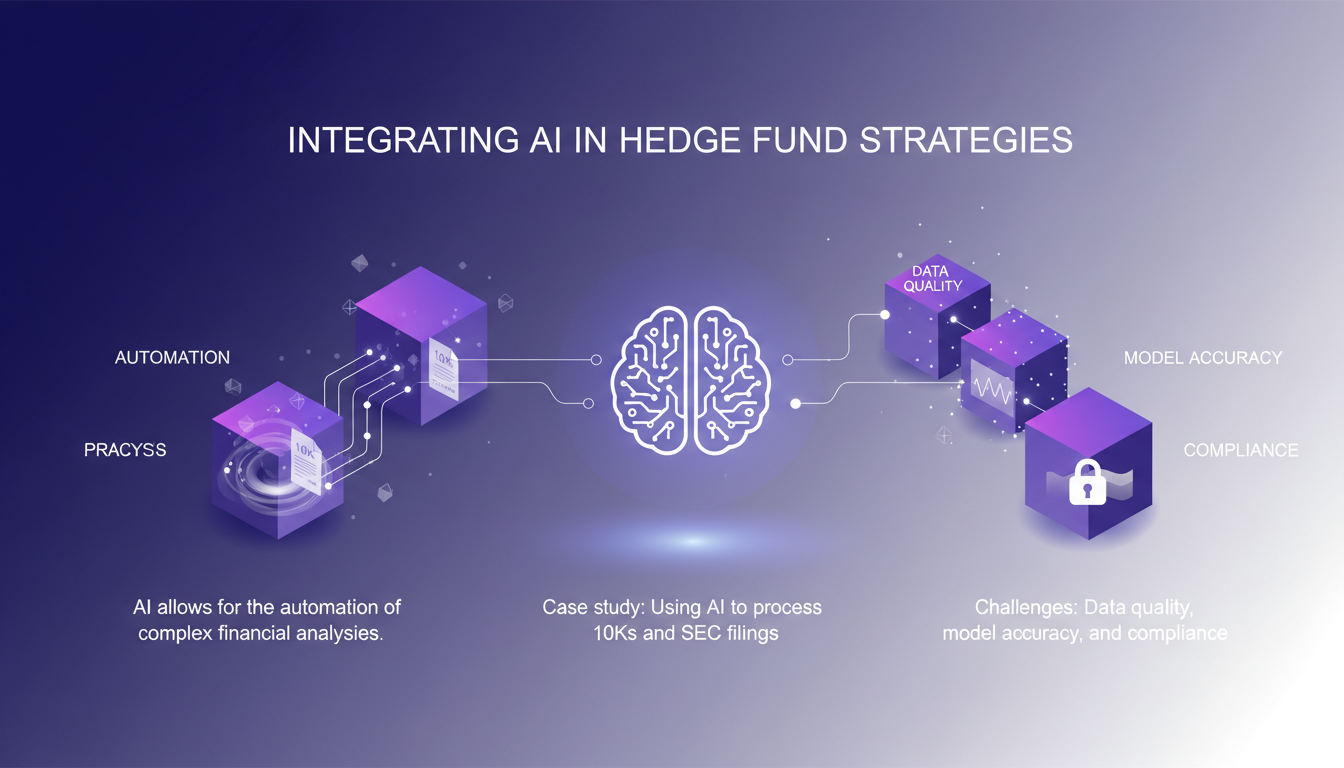

Integrating AI in Hedge Fund Strategies

Integrating AI into hedge fund strategies allows for the automation of complex financial analysis. Imagine using AI to process 10Ks and SEC filings—that's exactly what I've done. By analyzing these documents, AI extracted key information in record time.

However, there are challenges: data quality, model accuracy, and compliance. Don't rely solely on AI; human oversight is crucial to avoid costly mistakes.

In short, while AI can revolutionize strategies, it must be used wisely.

- Automation of complex financial analyses

- Challenges: data quality, accuracy, compliance

- AI should not replace human oversight

Automation of Financial Analysis with AI

With AI, automating the tedious parts of financial analysis is finally a reality. I use cloud agents to streamline data processing and strategy testing. The efficiency is remarkable: what used to take days now takes just hours.

But watch out for the initial setup costs and ongoing model training. Sometimes, the return on investment can take a while.

- Automation of tedious tasks

- Cloud agents for processing and testing

- Initial costs and ongoing model training

Emergence of AI Native Hedge Funds

AI native hedge funds, built from the ground up with AI, are transforming the industry. I've set up such a fund myself, and the flexibility and speed are impressive. Human errors are minimized, almost eradicated.

However, these funds must overcome regulatory hurdles and require robust infrastructure to function effectively.

- Increased flexibility and speed

- Reduction of human errors

- Regulatory hurdles and need for robust infrastructure

Challenges in Adopting AI in Traditional Hedge Funds

Adopting AI in traditional funds comes with its challenges. Resistance to change and legacy systems are significant barriers. Incremental integration is often the best approach.

I've found that pilot projects can help balance innovation with risk management. But be careful not to underestimate the importance of compliance.

- Resistance to change and legacy systems

- Incremental integration with pilot projects

- Importance of compliance

In conclusion, AI can transform hedge funds, but a thoughtful approach is essential. To learn more about LLM optimization, check out LLMs Optimization: RLVR and OpenAI's API or explore AI-Driven Quantitative Strategies: The New Frontier for Hedge....

Integrating AI into hedge funds is like strapping a rocket booster onto an already powerful engine. First, we witnessed the evolution of quantitative trading since the 1980s, using computers to analyze markets. Then, AI steps in, automating financial analysis with those notorious 10Ks. But watch out, it's no magic wand. Careful integration, continuous oversight, and adaptability are key. Looking ahead, AI is clearly redefining the game, but don't throw out the old playbook just yet. Ready to dive into AI-driven trading? Start small, iterate, and watch your strategies evolve. For more in-depth insights and practical tips, check out the "AI Native Hedge Funds" video on YouTube. That's where it's happening!

Frequently Asked Questions

Thibault Le Balier

Co-fondateur & CTO

Coming from the tech startup ecosystem, Thibault has developed expertise in AI solution architecture that he now puts at the service of large companies (Atos, BNP Paribas, beta.gouv). He works on two axes: mastering AI deployments (local LLMs, MCP security) and optimizing inference costs (offloading, compression, token management).

Related Articles

Discover more articles on similar topics

LLMs Optimization: RLVR and OpenAI's API

I've been knee-deep in fine-tuning large language models (LLMs) using Reinforcement Learning via Verifiable Rewards (RLVR). This isn't just theory; it's a game of efficiency and cost, with OpenAI’s RFT API as my main tool. In this tutorial, I'll walk you through how I make it work. We're diving into the training process, tackling imbalanced data, and comparing fine-tuning methods, all while keeping a close eye on costs. This is our third episode on reinforcement learning with LLMs, and we'll also discuss OpenAI's RFT API alternatives. Quick heads up: at $100 per hour, it escalates fast!

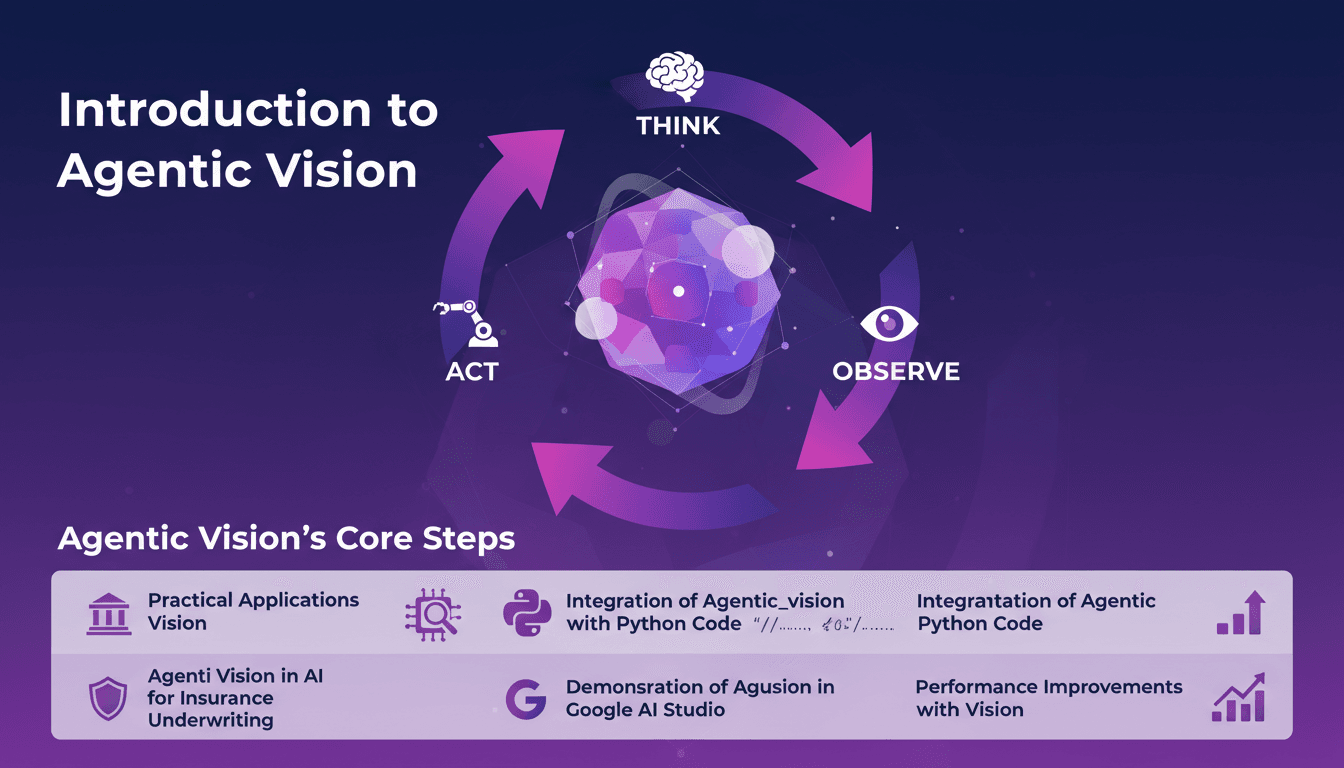

Agentic Vision: Boost AI with Python Integration

I remember the first time I stumbled upon Agentic Vision. It was like a light bulb moment, realizing how the Think, Act, Observe framework could revolutionize my AI projects. I integrated this approach into my workflows, especially for insurance underwriting, and the performance leaps were remarkable. Agentic Vision isn't just another AI buzzword. It's a practical framework that can truly boost your AI models, especially when paired with Python. Whether you're in insurance or any other field, understanding this can save you time and increase efficiency. In this video, I'll walk you through how I applied Agentic Vision with Python, and the performance improvements I witnessed, especially in Google AI Studio.

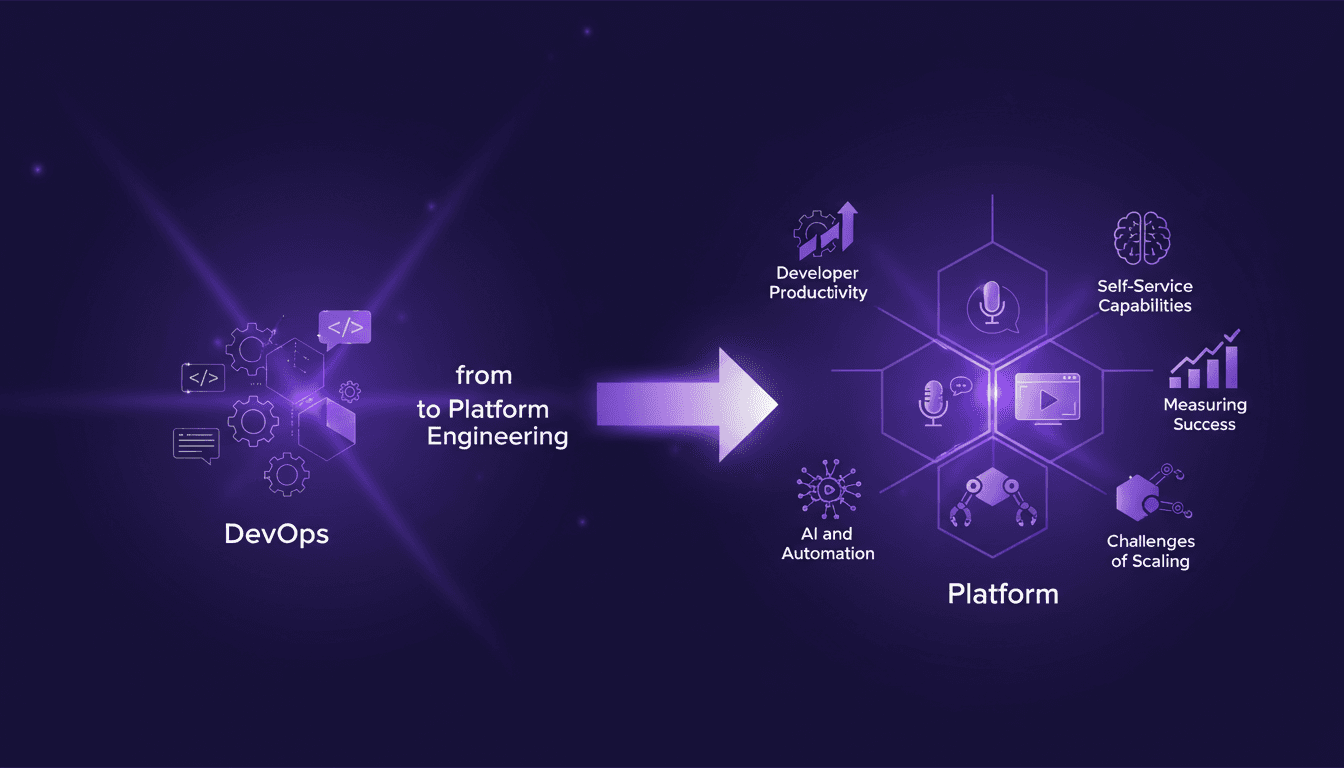

Transitioning from DevOps to Platform Engineering

I remember when DevOps was the buzzword. Now, platform engineering is taking the spotlight, and I've been right in the thick of it. With a decade of tech evolution under our belts, it’s more than just swapping buzzwords; it’s about real change. I’ve navigated this transition, and it’s been a game-changer for our productivity as software engineers. We’ll dive into what tools actually work, traps to avoid, and how AI and automation fit into the picture. In a nutshell, how we transition from DevOps to effective platform engineering without getting burned.

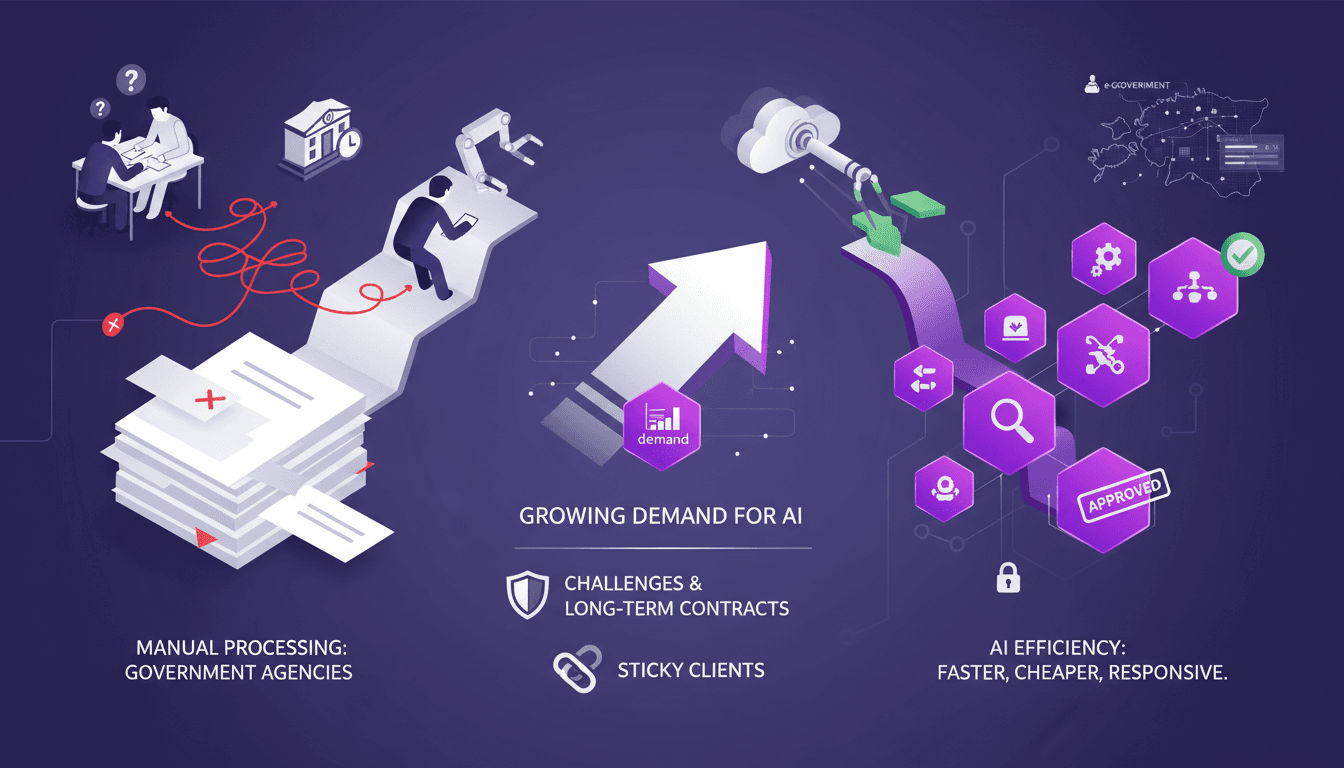

AI Efficiency in Government Processes

I remember the first time I saw AI transform a government form process. It was like watching a slow-moving train suddenly leap onto a high-speed rail. First, I connect the dots between AI and administrative forms, saving enormous time and cutting costs while improving accuracy. But watch out, selling AI to governments isn't without its challenges. Between inspiring examples like Estonia and long-term government contracts, there's much to learn to ensure AI isn't just another empty promise. I'll guide you through the real solutions I've piloted and how they've directly impacted the speed and accuracy of administrative processes.

SaaS Growth: Real Strategies and Challenges

I stopped all my training sessions to dive headfirst into building my SaaS. It wasn't just a pivot; it was a complete overhaul of how I approached business. Picture this: going from 3000 non-paying users to earning €25,000 in the first month, only to see it drop to €6,000 by the year's end. I share the real challenges I faced, the strategies I crafted (and re-crafted), and why product quality and user feedback are critical. The role of AI in all this? Essential, but watch out for the pitfalls.