Acquisition Strategies: Effective Methods

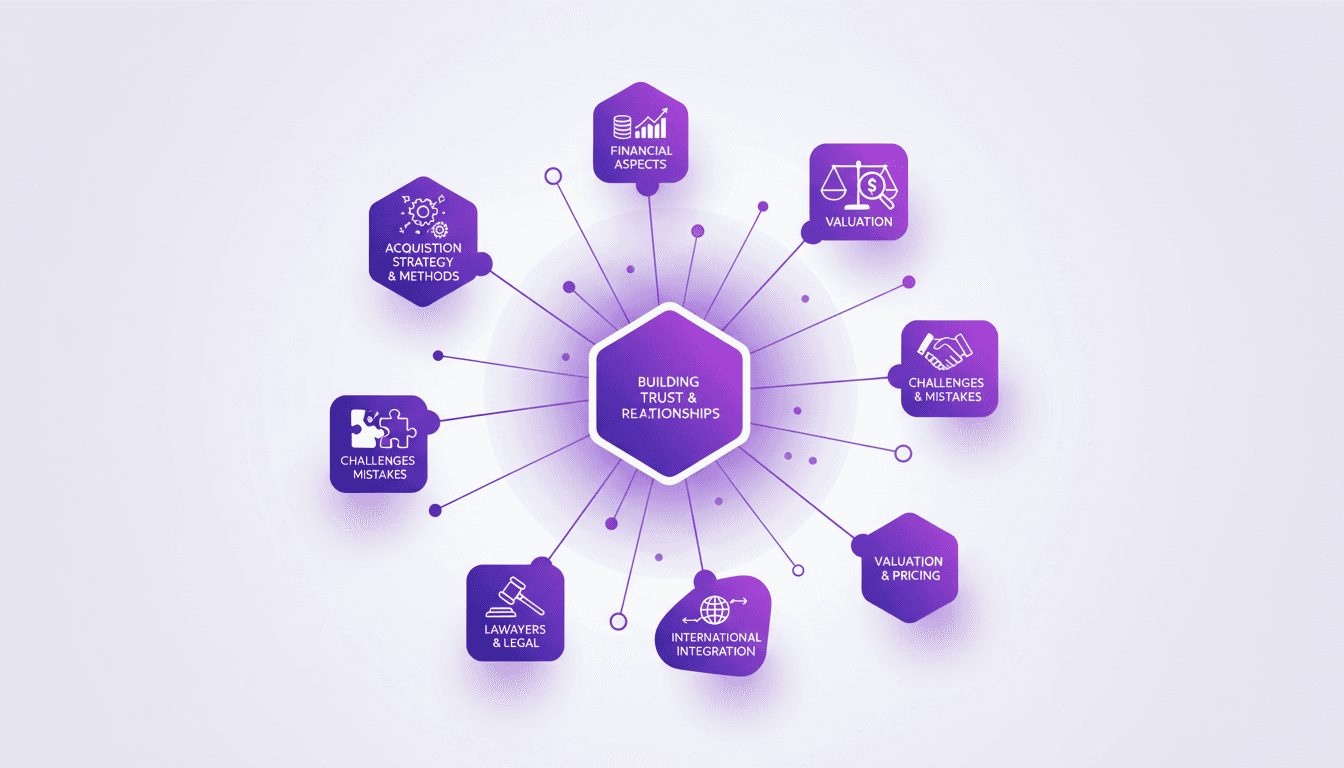

I've navigated the trenches of business acquisitions, spending 25M€ across several deals. Let me reveal the strategies that worked and the pitfalls to avoid. Acquiring a company isn't just a financial transaction. It requires solid strategy, trust-building, and meticulous planning. I'll walk you through my approach, from initial strategy to post-acquisition integration. We'll dive into acquisition strategy, financial aspects, building trust in business deals, challenges and mistakes to avoid, and the critical role of lawyers. And if you're considering international expansion, we'll also touch on market entry.

When it comes to acquiring companies, I've been in the thick of it. I've spent 25M€ across multiple deals and learned the hard way. So, how do I do it? First, I lay down a clear strategy. It's not just about writing a check; it's about building trust, often transferring 20% in trust cases, and planning every step meticulously. Lawyers? I've had up to 10 on some deals. They're crucial for navigating legal complexities. But watch out, mistakes are easy to make. I've seen deals fall apart over overlooked details. After the purchase, integration is key. Poor integration can ruin even the best acquisition. And if you're eyeing new markets, be ready for unique challenges. I share my methods, successes, and failures to help you avoid the same pitfalls.

Acquisition Strategy and Initial Steps

When it comes to acquiring companies, the first step is to define clear acquisition goals. Without a clear vision, you're just flying blind and risking both time and money. In my experience, I always start by setting precise acquisition objectives. This helps me target businesses that align with our overall strategy. It's not just about growing, but growing smartly.

Once the goals are set, I assess potential targets for their alignment with our business objectives. Then comes the question of upfront payments and earnouts. I've been burned before by underestimating the importance of upfront payments. On the other hand, earnouts, where the price is adjusted based on future performance, can be a powerful lever. But watch out, it requires transparent communication from the start to build trust. Trust is essential and it's built through honest and open exchanges.

Financial Aspects and Valuation Techniques

In my acquisition experiences, I've spent 25 million euros, which is no small feat. Each deal was structured differently but always with a focus on financial rigor. I use valuation methods like EBITDA multiples and discounted cash flow (DCF). These have helped justify the amounts invested. However, don't underestimate the role of escrow or vendor credit. These tools secure transactions and reassure both parties.

Pricing strategy and negotiation are equally crucial. I've often chosen to overpay to quickly secure a deal and avoid competition. But it's a delicate balance, and you need to know how far to go without compromising financial viability.

Building Trust and Managing Relationships

Trust with founders and stakeholders is paramount. For me, it starts with simple techniques: being transparent, sharing numbers, and not hesitating to reduce an initial offer if necessary. It may seem risky, but if done with tact and respect, it can strengthen the relationship. Transparency is also key in negotiations.

- Transparency in exchanges

- Respecting sellers' needs

- Maintaining a good relationship even after reducing an offer

Relationship management is a key skill for successful integration. It requires constant attention and a willingness to adapt.

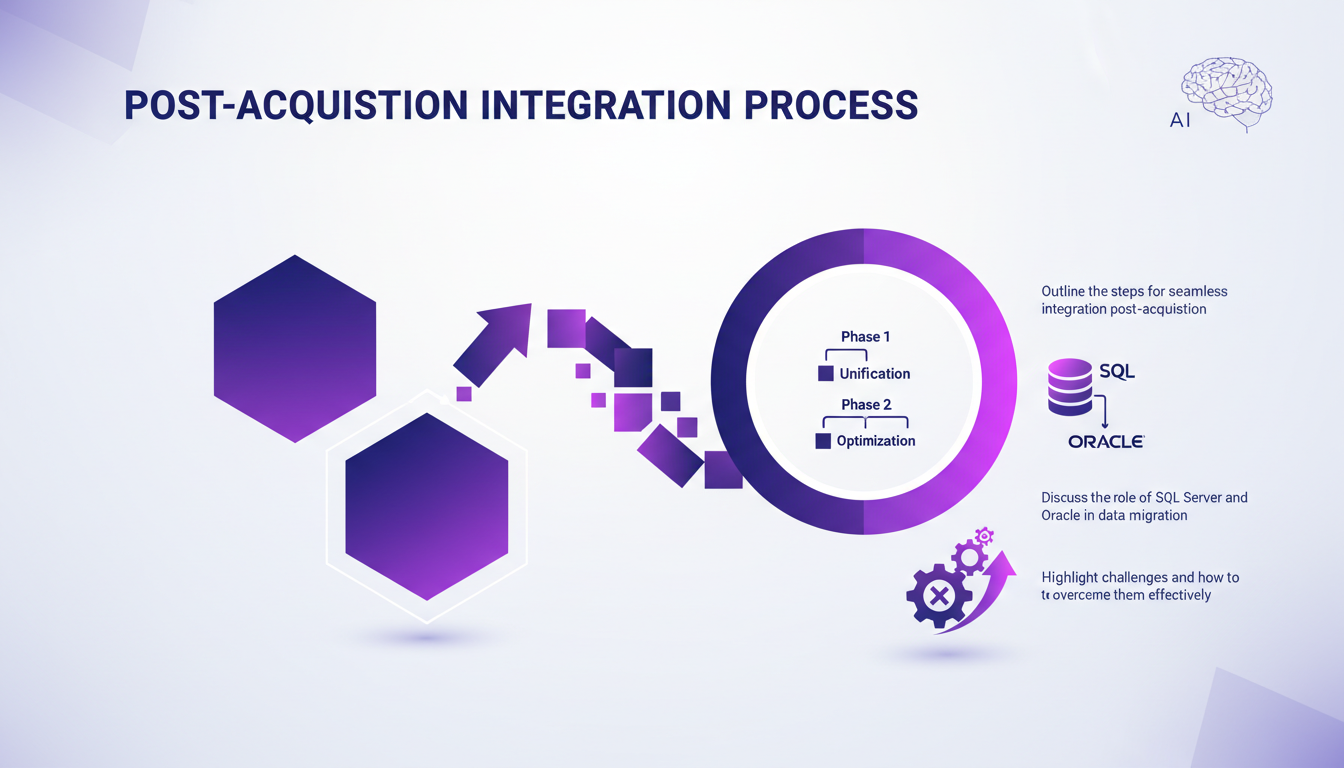

Post-Acquisition Integration Process

Post-acquisition integration is often the real challenge. I've learned that it's crucial to structure the process to be as smooth as possible. This starts with data migration, often using tools like SQL Server and Oracle. The challenges here are numerous, including system compatibility and company culture.

To succeed, you need to align cultures and systems. This requires patience and a good deal of flexibility. It's crucial to communicate expectations clearly and ensure everyone is on the same page.

Legal Considerations and International Expansion

Legal aspects should not be overlooked. I've always worked with a competent team of lawyers (up to 10 in some cases) to handle the complexities of acquisitions, especially internationally. Each country has its own regulations, and it's essential to comply to avoid future problems.

I always advise being well-prepared for international legal challenges. A good legal strategy should include understanding local laws and an ability to navigate cross-border complexities.

Navigating acquisitions feels like orchestrating a complex symphony: each step needs precise planning and execution. Here's what I've learned in the trenches:

- First, having a clear strategy is non-negotiable. Without it, those 25M€ you're ready to spend might go down the drain.

- Second, trust is your secret weapon, with 20% of deals succeeding because of it. But remember, building it takes time and effort.

- Lastly, don't underestimate the financial and legal nuances. With 10 lawyers involved, it's a meticulous process requiring patience.

Acquisitions can be a real game changer for your business, but you need to be ready to invest time and energy. So, ready to dive in? Start by defining your strategy and building trust with potential partners.

To truly grasp the intricacies of this method, I recommend watching the full video. It's like having a chat with a seasoned colleague finally sharing their secrets. Watch the video

Frequently Asked Questions

Thibault Le Balier

Co-fondateur & CTO

Coming from the tech startup ecosystem, Thibault has developed expertise in AI solution architecture that he now puts at the service of large companies (Atos, BNP Paribas, beta.gouv). He works on two axes: mastering AI deployments (local LLMs, MCP security) and optimizing inference costs (offloading, compression, token management).

Related Articles

Discover more articles on similar topics

Voice Cloning: Efficient Model for Commercial Use

I dove into voice cloning out of necessity—clients needed unique voiceovers without the hassle of endless recording sessions. That's when I stumbled upon this voice cloning model. First thing I did? Put it against Eleven Labs to see if it could hold its ground. Voice cloning isn't just about mimicking tones—it's about creating a scalable solution for commercial applications. In this article, I'll take you behind the scenes of this model: where it shines, where it falters, and the limitations you need to watch out for. If you've dabbled in voice cloning before, you know technical specs and legal considerations are crucial. I’ll walk you through the model's nuances, its commercial potential, and how it really stacks up against Eleven Labs.

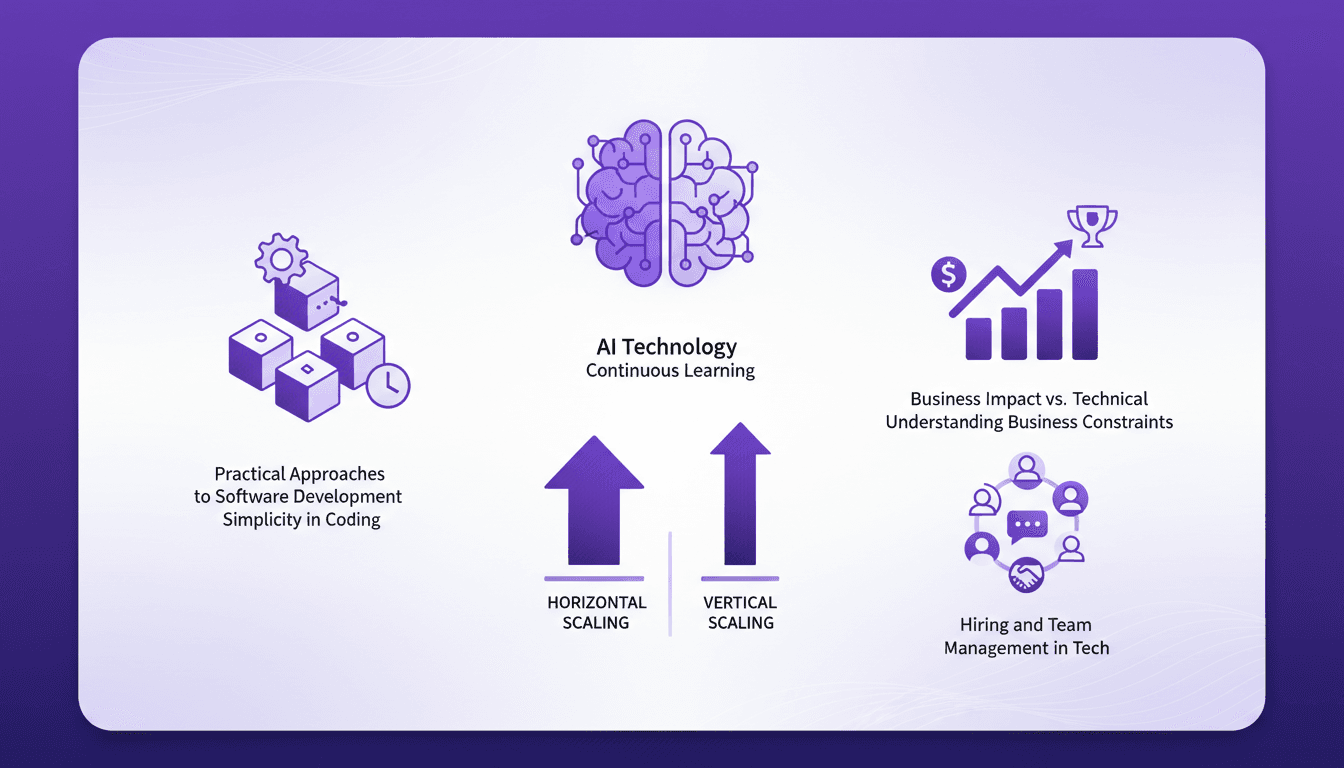

Designing Scalable Systems: Practical Approach

When I first joined GitHub, scaling quickly became more than a buzzword—it was a daily reality. Handling millions of requests per second isn't just an engineering feat; it's essential. Let me walk you through how I approach system design, scaling, and the real-world trade-offs we face. This isn't about theory; it's about what works in the trenches. We'll cover vertical vs. horizontal scaling, the importance of simplicity in code, and even hiring the right tech team. Because ultimately, it's the practical solutions that matter.

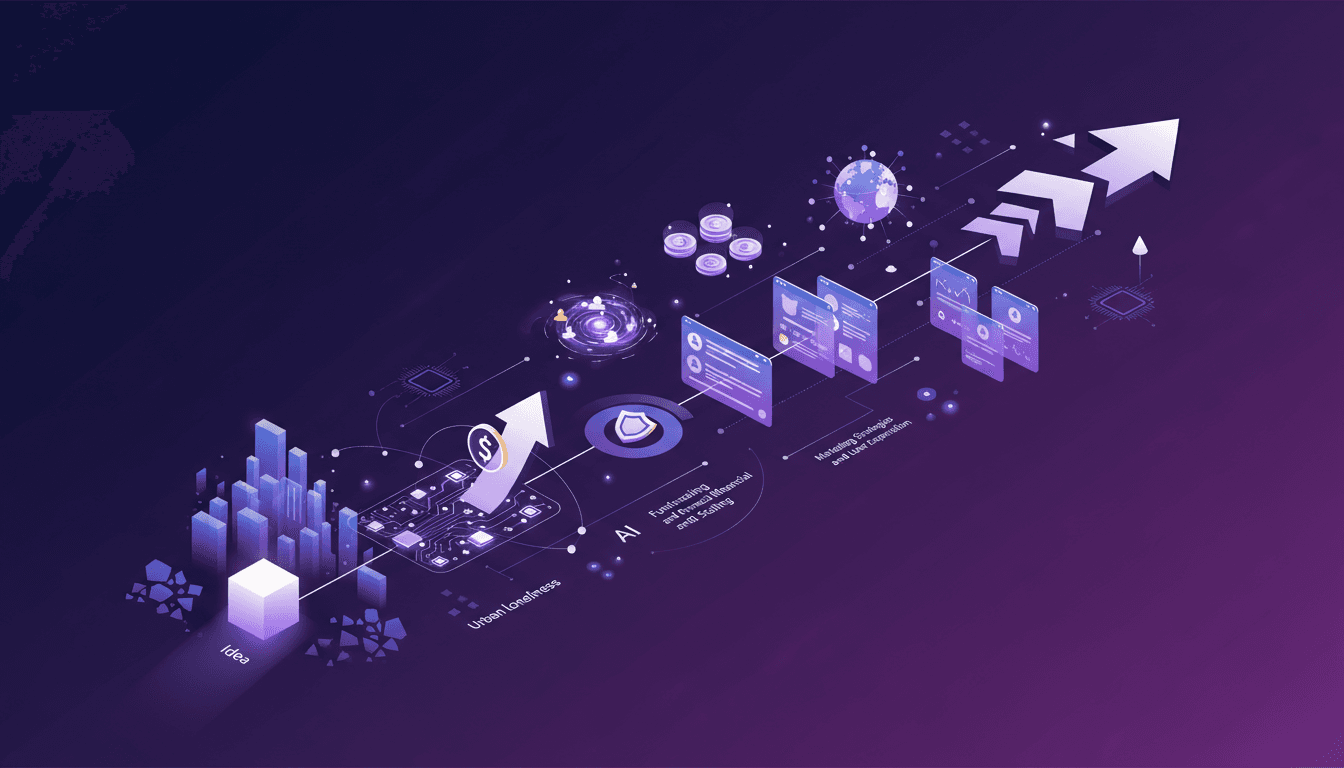

Building a 20M€ ARR App: My Journey

I didn't set out to build a 20M€ ARR app. It all started with a list of 100 dreams after Christmas 2019. Fast forward to today, and we're in 52 countries, tackling urban loneliness head-on. I orchestrated the development, navigated through financial challenges, and adjusted our business model to reach a global audience. This journey is more than just code; it's about human connection. In this article, I take you behind the scenes of our entrepreneurial journey, from the initial idea to managing global expansion. If you're ready to see how an idea turns into success, dive in with me.

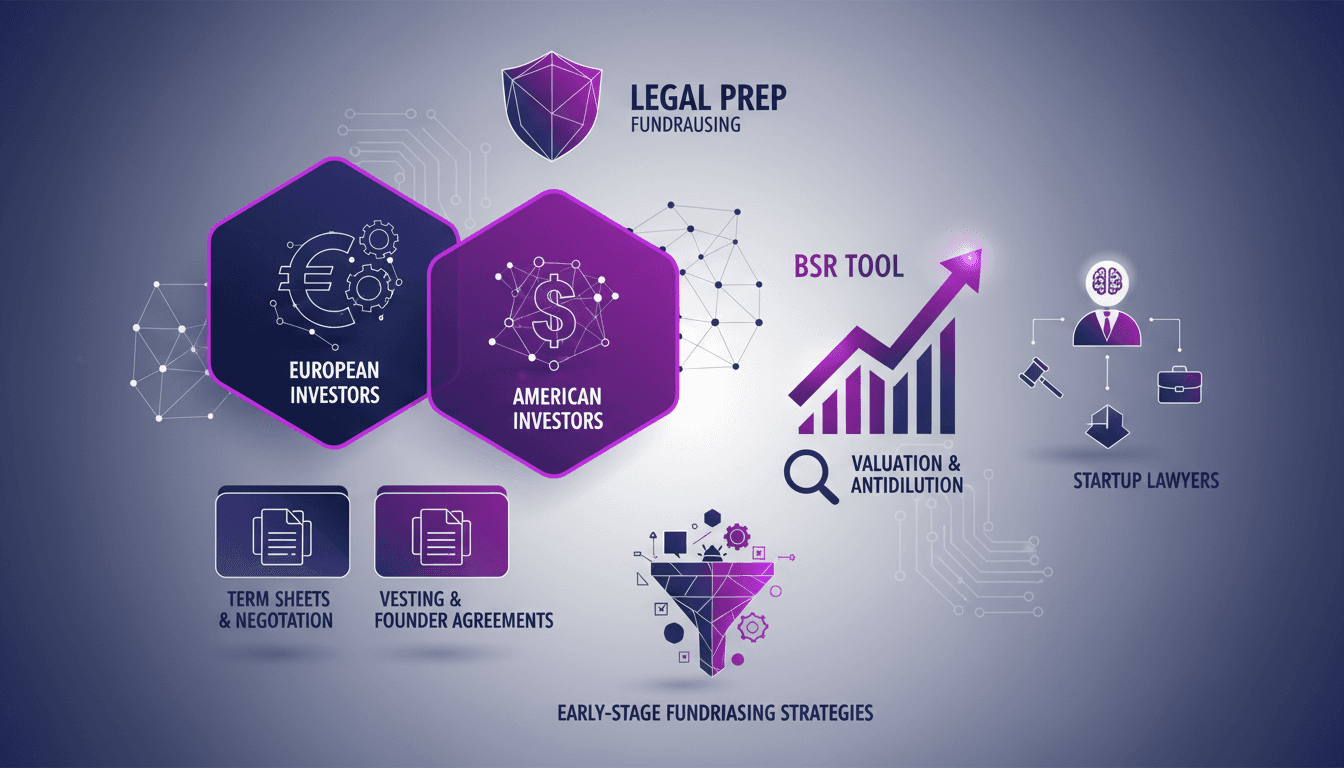

Raise Funds Without Losing Control: Key Strategies

Raising funds is like sailing through a storm. I've been through the fundraising wringer more times than I can count, and if there's one thing I've learned, it's this: preparation is everything. Whether you're dealing with European or American investors, every detail matters. Let me guide you through this maze without losing your shirt—or your company. We're diving into everything: the differences between European and American investors, legal prep, term sheets, and even using BSR as a fundraising tool. Don't get burned by antidilution clauses or inflated valuations. Let's explore key strategies to raise funds without losing control.

Deploying Kimmy K2: My Workflow Experience

I've been hands-on with AI models for years, and when I got my hands on the Kimmy K2 Thinking model, I knew I was diving into something potent. This model marks a significant evolution, especially coming from a Chinese company. With its impressive technical capabilities and implications for the future of AI, Kimmy K2 isn't just another model; it's a tool that excels in real-world applications. Let me walk you through how it stacks up against others, its technical features, and why it might be a game changer in your workflow.