Stable Coins in Global Finance: A Guide

I've been knee-deep in the world of stable coins, and let me tell you, they're not just a buzzword. They're reshaping how we think about global finance. First, I connected with the core idea: stable coins as critical infrastructure. Then, I dove into the regulatory maze of the Genius and Clarity Acts. If you're in the financial services game, you'll want to stick around. Stable coins are becoming the backbone of modern financial systems, bridging the gap between decentralized finance (DeFi) and traditional finance. This article explores their role, regulatory impacts, and opportunities for financial services.

I've been knee-deep in the world of stable coins, and let me tell you, they're not just a buzzword — they're reshaping how we think about global finance. First, I connected with the core idea: stable coins as critical infrastructure. Then, I dove into the regulatory maze of the Genius and Clarity Acts. If you're in the financial services game, you'll want to stick around. Stable coins are becoming the backbone of modern financial systems, bridging the gap between decentralized finance (DeFi) and traditional finance. We're going to explore their role in this space, the regulatory impacts, and the opportunities they offer financial services. Think better yield accounts or access to tokenized real-world assets — strategic choices for businesses and individuals alike. With stable coins, cross-border money movement transforms into a vital infrastructure. So, ready to see how these stable coins can transform your approach to financial services?

Understanding Stable Coins and Their Global Role

Stable coins, those digital tokens that hold a stable value against fiat currencies like the dollar or euro, are like a bridge between fiat money and cryptocurrencies. They’re seen as critical infrastructure because they reduce volatility—which is crucial for cross-border transactions. I've seen firsthand how companies use them to transfer money quickly and efficiently, bypassing the traditional banking fees.

But don't be fooled, their impact isn't just on paper. Stable coins are transforming global finance, and even traditional banks must adapt. Think about international money transfers: with stable coins, you can avoid fluctuating exchange rates and endless banking delays.

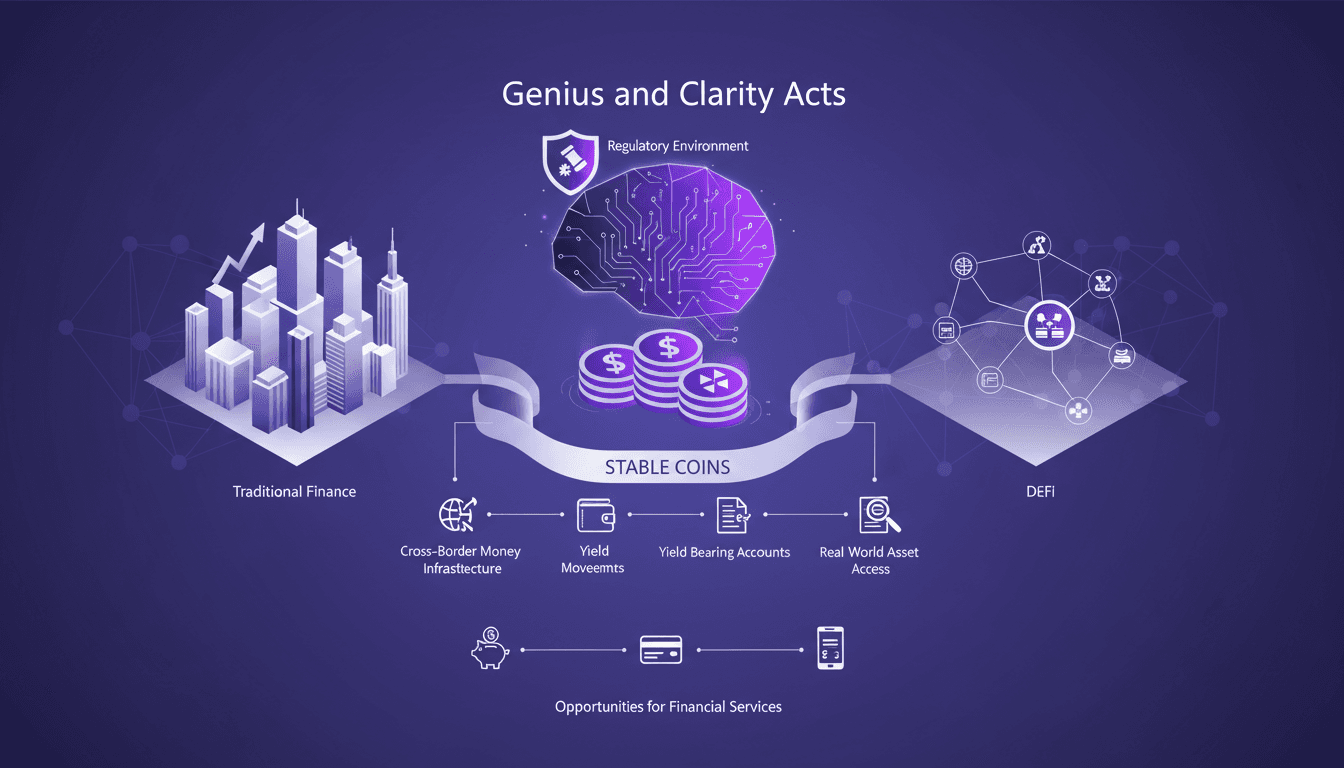

Regulatory Landscape: Genius and Clarity Acts

Now, let's talk about the Genius and Clarity Acts. These laws are major turning points for integrating stable coins into the legal framework. They clarify how these assets can be used legally. It's like laying the foundation for a solid house. The Genius Act, for example, has paved the way for more institutional adoption and expansion of the stablecoin ecosystem. JP Morgan even predicted that this act could accelerate stablecoin adoption, making them more mainstream.

These laws offer clear benefits for financial services, but they also pose challenges. Navigating these regulatory waters requires a clear understanding of the legal implications.

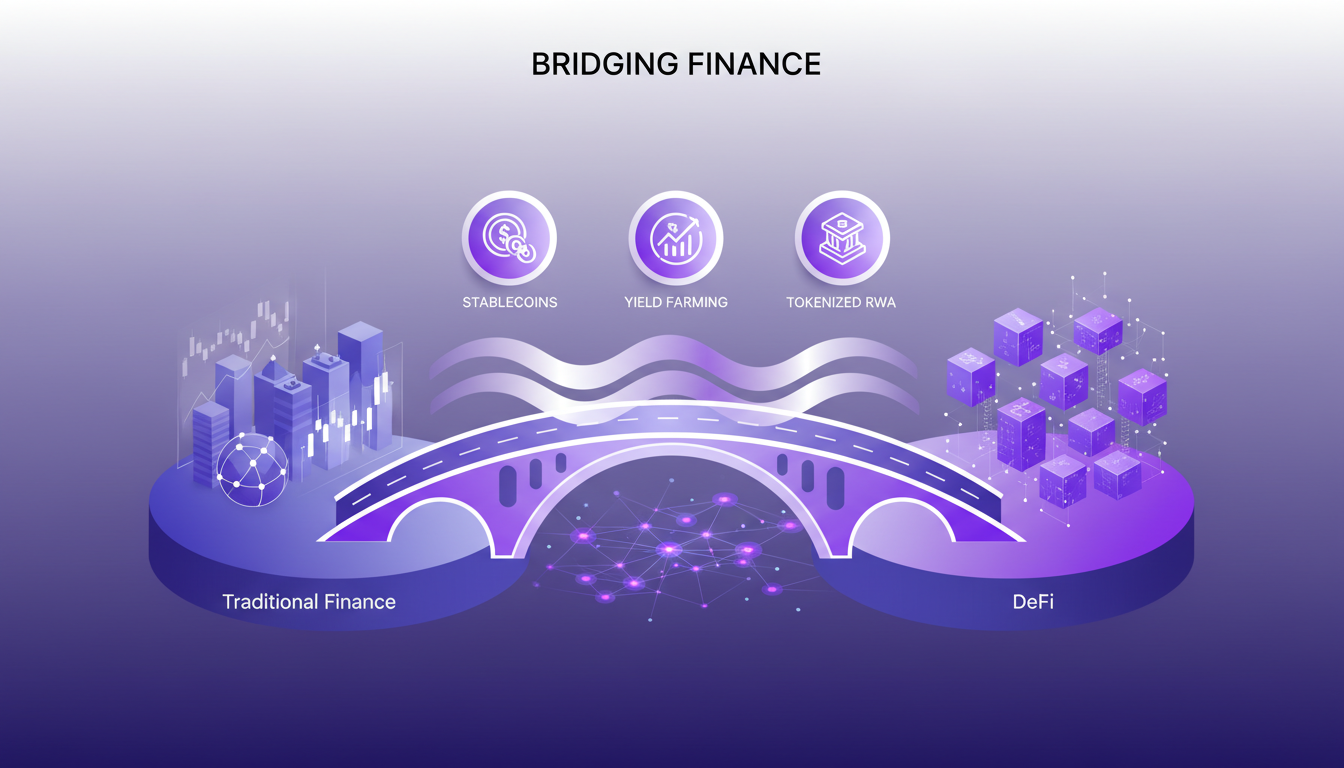

Bridging DeFi and Traditional Finance

I'm telling you, stable coins are the missing link between DeFi and traditional finance. With them, you can access interesting yields through DeFi while enjoying the stability of regulated assets. Imagine investing in tokenized real-world assets while staying compliant with regulations. It's doable, but watch out for the trade-offs between regulated and unregulated financial products.

Companies can now choose between regulated financial products with limited upside and unregulated cryptos with real risk. Stable coins offer a middle ground, facilitating innovation while staying within a legal framework.

Opportunities in Financial Services

You might think there's nothing new under the sun in financial services, but stable coins are changing the game. Yield-bearing accounts, for instance, are becoming more attractive thanks to stable coins. They offer yield opportunities without the volatility risks of traditional cryptos.

Businesses and individuals can leverage tokenization to access real-world assets. It's a revolution that could make financial operations more efficient and less costly. Imagine a world where money moves faster and cheaper thanks to stable coins.

Innovating Within the Regulatory Environment

Innovating in this complex regulatory landscape is like walking a tightrope. You have to balance compliance with financial innovation. Strategies for navigating this terrain include a deep understanding of laws and anticipating future regulatory changes. Sometimes it's faster to adapt to new rules than to work around them.

Future trends might include stricter regulation but also increased opportunities for innovation. Staying informed and agile is crucial to capitalize on these changes.

In summary, stable coins are not just stable currencies. They're the catalyst for a global financial transformation. If you're building something in this space, take advantage of this open regulatory window and the rails being laid to innovate.

First off, stable coins are not a passing trend; they're genuinely a game changer in how we handle finance. I've seen firsthand how they bridge DeFi and traditional finance, but remember, with great potential comes the need for careful orchestration, especially navigating complex regulatory frameworks. On the concrete side, we're talking better yield offerings from DeFi benefits, easier access to tokenized real-world assets, and regulated financial products that appeal to both businesses and individuals.

Looking forward, stable coins could well become a central pillar in financial services, but this demands constant innovation and rigorous regulatory vigilance. If you're ready to dive in, start by evaluating your current infrastructure and compliance needs. Stay informed, stay compliant, and most importantly, stay innovative.

I highly recommend checking out the 'Stablecoin Financial Services' video for deeper insights into this exciting field. It's available here: YouTube.

Frequently Asked Questions

Thibault Le Balier

Co-fondateur & CTO

Coming from the tech startup ecosystem, Thibault has developed expertise in AI solution architecture that he now puts at the service of large companies (Atos, BNP Paribas, beta.gouv). He works on two axes: mastering AI deployments (local LLMs, MCP security) and optimizing inference costs (offloading, compression, token management).

Related Articles

Discover more articles on similar topics

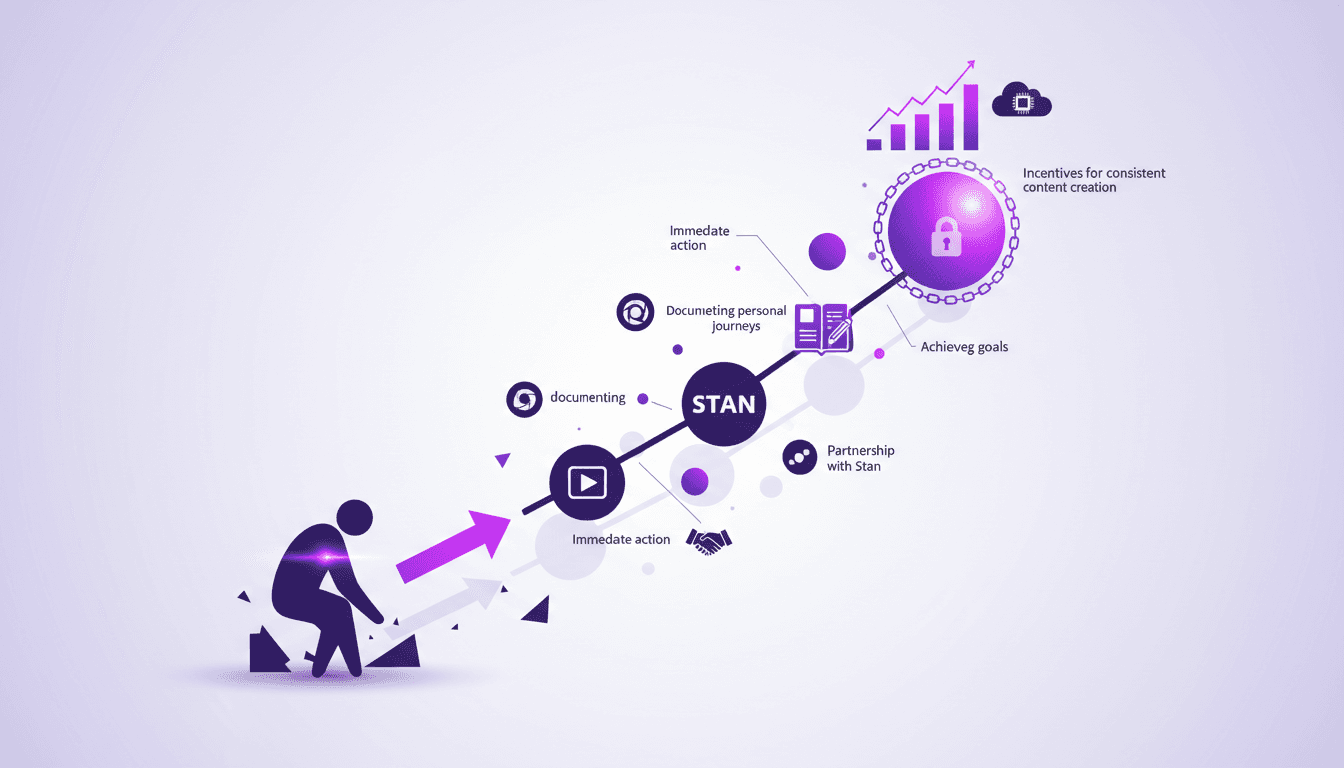

Overcome Doubt: Act in 40 Seconds

I remember those days of being stuck, trapped by doubt. Then, just one pivotal moment flipped the script for me. I did the same for someone else in just 40 seconds. In the world of content creation, excuses can hold you back. But with a mindset shift and a nudge, you can break free. I helped someone overcome their hesitation and dive into creating content, with a shot at winning a share of $100,000 in just 30 days. If you've ever wanted to document your journey and stay motivated, this is your moment.

Tech Entrepreneurship: How I Drive the Revolution

I remember the first time I realized the sheer power of tech entrepreneurship. It was a game changer, watching companies evolve from garage startups to market giants. But how do we navigate this ever-evolving landscape? Today, tech entrepreneurs aren't just participants; they're leaders shaping the future. In this podcast, I dive into how we, as tech builders, can harness this power. I discuss the role of tech in major market capitalizations, challenges for tech CEOs, the impact of AI, and the French tech ecosystem. Ready to explore?

Optimizing Marketing with Zeta Global's AI

I remember like it was yesterday, the first time I integrated Zeta Global's AI platform into a marketing strategy. The ROI was jaw-dropping—6 to 700% for every dollar spent. In today's competitive landscape, leveraging AI can make all the difference. Let's talk about how I turned complex AI concepts into a smarter marketing engine. With Zeta, it's about big data, efficiency, and impact. We'll dive into orchestrating this tech, from generative AI to quantum computing, and the human role in this AI-driven industry.

Deploying Open Clow: Key Features and Insights

I remember the first time I deployed Open Clow, thinking I'd be stuck for hours. But in under five minutes, I was live. This open-source AI assistant is a game changer, but you need to know how to navigate its pitfalls. With over 150,000 stars on GitHub, Open Clow isn't just hype. It's reshaping how we think about AI assistants and automation. In this post, I'll dive into its key features, security risks, and how it could become your virtual employee. We'll also look at technical requirements, costs, and real user experiences. Ready to see why Open Clow is turning the game upside down?

Choosing Knowledge Over Cash: My Journey

I was faced with a simple choice: take $1,000 cash or a book. I chose the book, and that decision turned out to be a game-changer. In a world obsessed with quick wins, I learned that knowledge often trumps fast cash. Here, I share what this journey taught me about entrepreneurship and the importance of investing in oneself. Instead of settling for quick money, I bet on knowledge, and it paid off in the long run. This journey also highlighted the critical role of mentorship and guidance in personal growth. In short, choosing the book was a winning bet.